24+ debt ratio for mortgage

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web DTI is less than 36.

Wholesale Equity Solutions Lender And Investor Aaa Lendings

Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment.

. Web Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36 percent or lower. Web Divide Step 1 by Step 3. Web Here are debt-to-income requirements by loan type.

Web Simple definition. Your debt is likely manageable relative to your income. 28 of your income will go to your mortgage payment and 36 to all your other household debt.

Get competitive rates terms rural expertise and local service from Rural 1st. 200 50 of. Web In general lenders prefer that your back-end ratio not exceed 36.

DTI is 36 to 42. Ad Get an idea of your estimated payments or loan possibilities. Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage.

Thats your current debt-to-income ratio. You shouldnt have trouble accessing new lines of credit. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Estimate Your Monthly Payment Today. Apply Online To Enjoy A Service. Lenders prefer you spend 28 or less of your gross monthly.

250 Property taxes. Web Calculating the front-end DTI is easy because the focus is only on the new mortgage obligations. Youll usually need a back-end DTI ratio of 43 or less.

Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Highest Satisfaction for Mortgage Origination. More Veterans Than Ever are Buying with 0 Down.

2500 Mortgage payments. Lenders look at your new housing payment including principal. Heres how lenders typically view DTI.

Ideally lenders prefer a debt-to-income ratio lower than 36 with no more. 1 2 For example assume. Multiply your answer by 100 to.

Web Your monthly debts include 1000 for rent a 400 car payment a 250 student loan payment and three credit cards youre paying off with 35 minimums each. Web Theyre looking to purchase a home and have estimated their monthly housing costs to be as follows. Web The gross debt ratio is defined as the ratio of monthly housing costs including mortgage payments home insurance and property costs to monthly income.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. Web If your income varies estimate a typical months earnings. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly. If your home is highly energy-efficient and you.

Try our mortgage calculator. Divide your total monthly debt payments by your gross monthly income. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3. Some lenders may accept a debt-to-income ratio of 45 or higher when you are buying a home with a conventional loan but these higher DTIs usually come with higher credit and income requirements. That means if you earn 5000 in monthly gross income your total debt obligations should be 1800 or less.

Web 8 hours agoYour debt-to-income ratio DTI includes your mortgage maintenance or taxes and any other long-term debt including credit cards auto payments and other. Web The 2836 rule is an addendum to the 28 rule. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

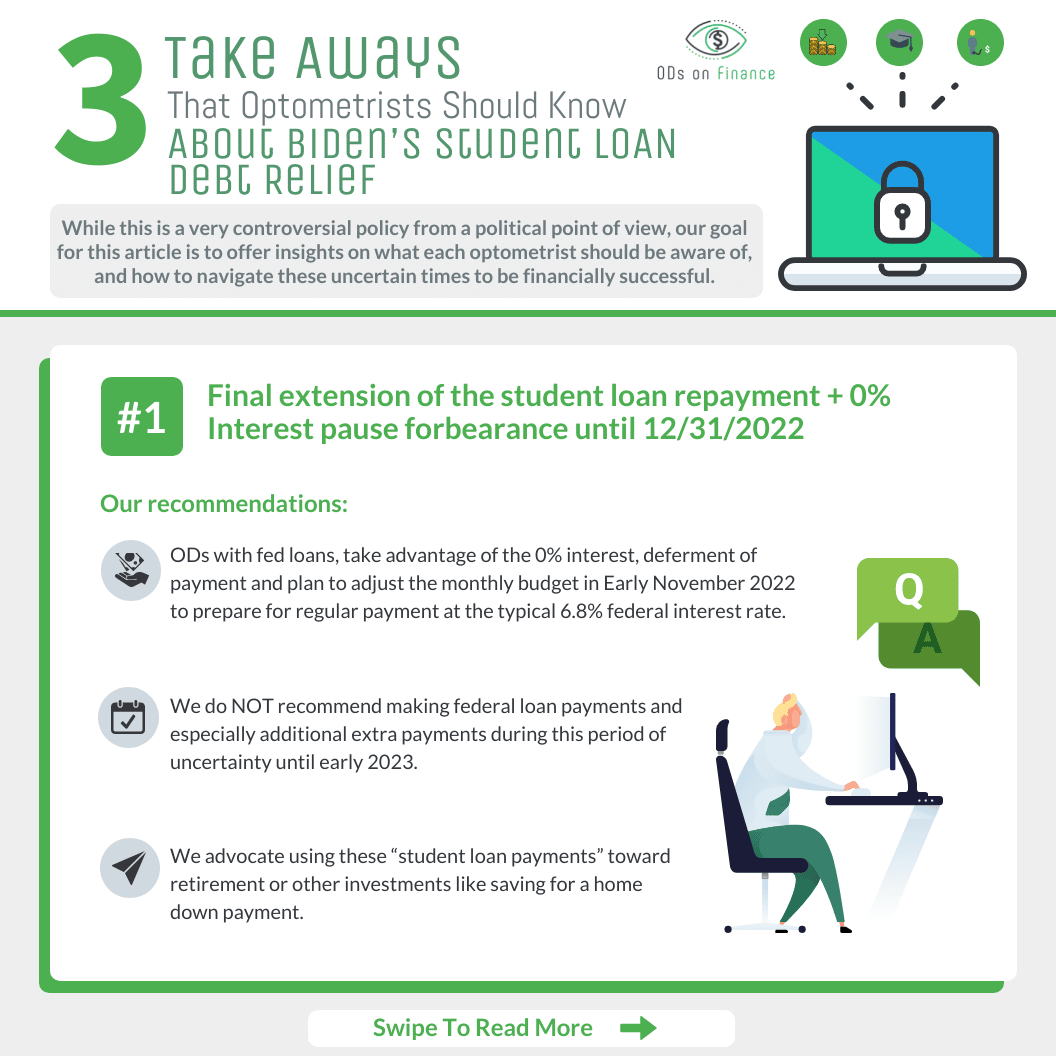

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

How To Get A Loan With A High Debt To Income Ratio 2023

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

Debt To Income Ratio Dti What It Is And How To Calculate It

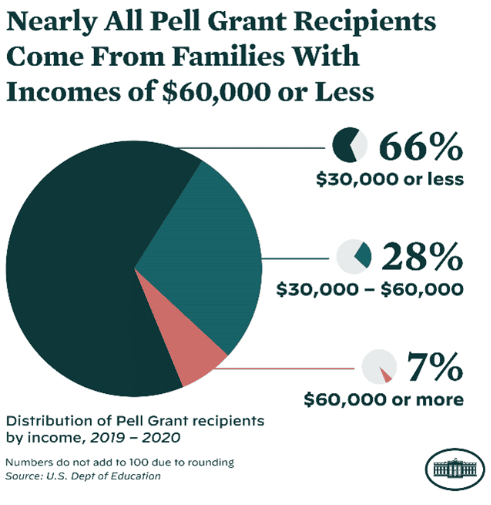

Exhibit

Understanding Debt To Income Ratio When Buying A Home

Ex992supplement

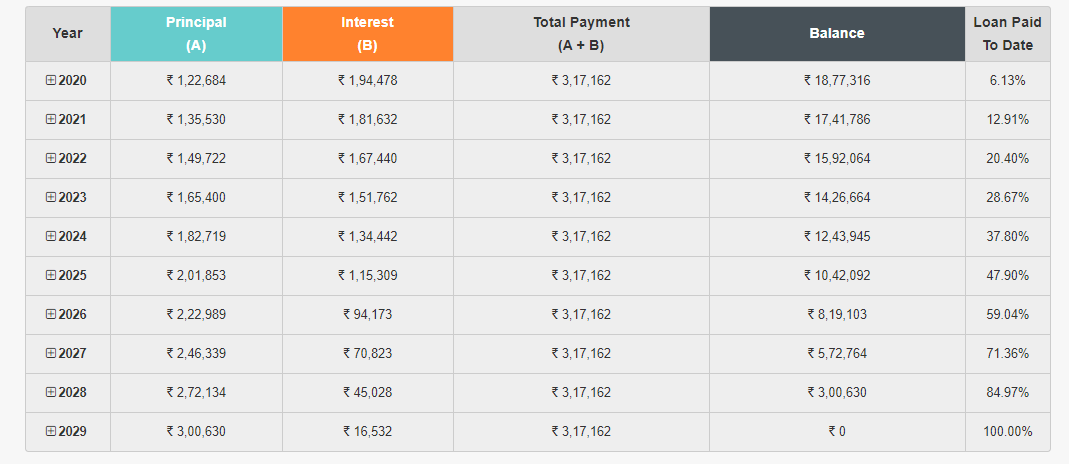

What Is Loan Repayment And Why Is It Important Moneytap

Debt To Income Ratio Calculator What Is My Dti Zillow

3 Take Aways That Optometrists Should Know About Biden S Student Loan Debt Relief Ods On Finance

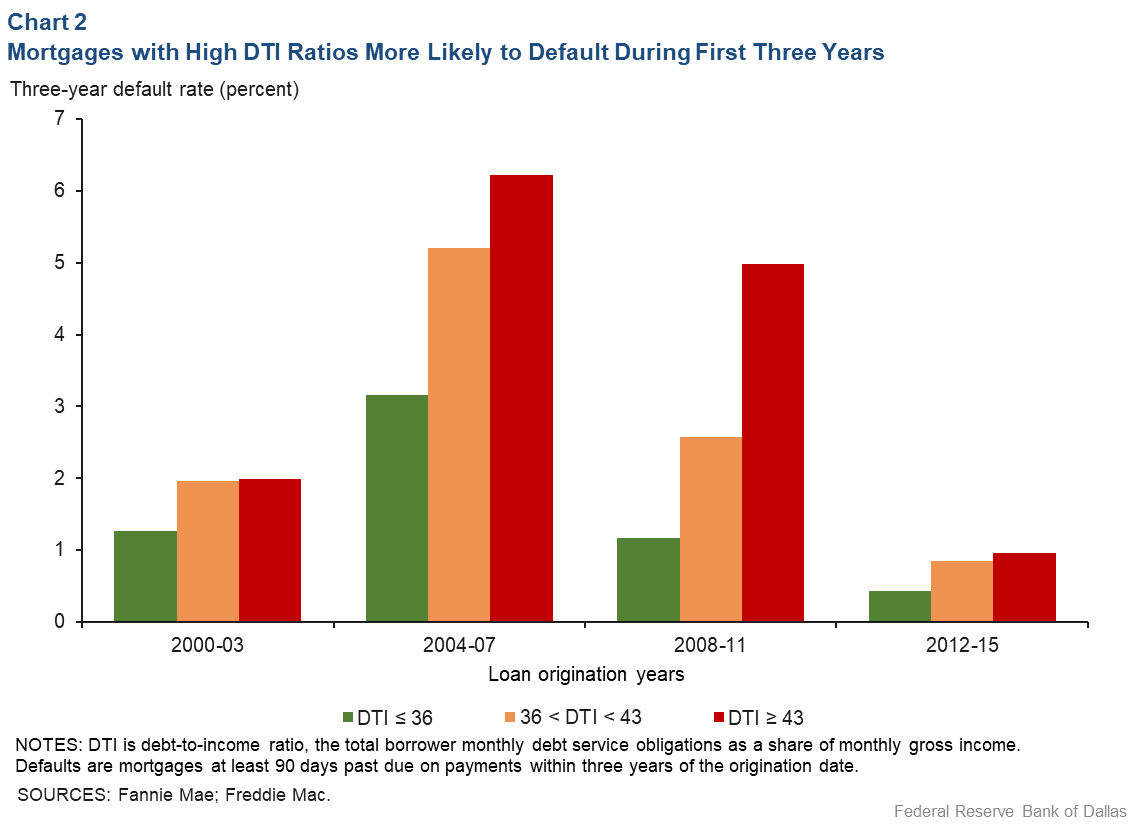

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

Debt Ratio And Debt To Income Ratio

What Is The 28 36 Rule Lexington Law