Payroll calculator 2023 free

500001 1000000. Big on service small on fees.

General Schedule Gs Base Pay Scale For 2022

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and.

. Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks. Take a Guided Tour.

Get your payroll done right every time. 2022 Federal income tax withholding calculation. Tax Year for Federal W-4 Information.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Run your business. Expected DA January 2022.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. When you choose SurePayroll to. Ad Create as many PTO policies on your account as you need.

Its so easy to. See where that hard-earned money goes - with UK income tax National Insurance student. Use our PAYE calculator to work out salary and wage deductions.

Its so easy to. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Or use any of these four Free W-4 tools later.

Subtract 12900 for Married otherwise. Sage Income Tax Calculator. The standard FUTA tax rate is 6 so your max.

On Tuesday February 1 2022 Finance Minister Shri Nirmala Sitharaman announced the huge Indian Budget. Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. AFD CSD Price 2022.

We can also help you understand some of the key factors that affect your tax return estimate. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. 2022 Federal income tax withholding calculation.

All other pay frequency inputs are assumed to be holidays and vacation. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Ad The Best HR Payroll Partner For Medium and Small Businesses.

Employees can check PTO balances and any upcoming time off right from their phones. Our free tax calculator is a great way to learn about your tax situation and plan ahead. Heres a step-by-step guide to walk you through.

Expected DA July 2021. Well run your payroll for up to 40 less. Deductions from salary and wages.

Ad Compare This Years Top 5 Free Payroll Software. Free Unbiased Reviews Top Picks. Computes federal and state tax withholding for.

Subtract 12900 for Married otherwise. Paycors Tech Saves Time. FAQ Blog Calculators Students Logbook.

Ad Create as many PTO policies on your account as you need. 7th CPC Pay Calculator. Employers and employees can use this calculator to work out how much PAYE.

Prepare and e-File your. Employees can check PTO balances and any upcoming time off right from their phones. You may be an established company in Ireland looking to quickly calculate the payroll costs in Ireland for a new branch or team or you may be looking to setup a business in Ireland in 2022.

How much is 75k a paycheck. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. The 2023 Calculator on this page is currently based on the latest IRS data. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

As the IRS releases 2023 tax guidance we will update this tool. Calculate how tax changes will affect your pocket. Choose Tax Year and State.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. It will be updated with 2023 tax year data as soon the data is available from the IRS. Our Expertise Helps You Make a Difference.

Filing Status Children under Age 17 qualify for child tax credit Other Dependents. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

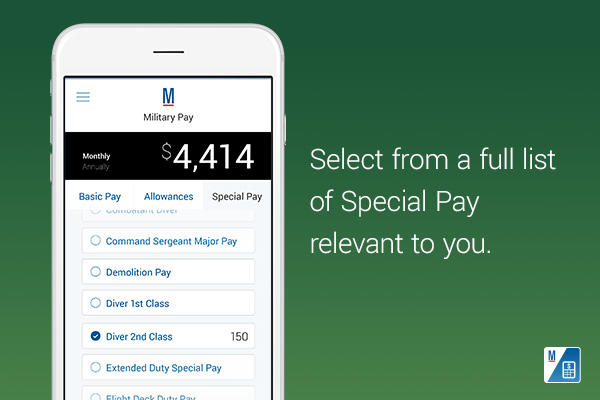

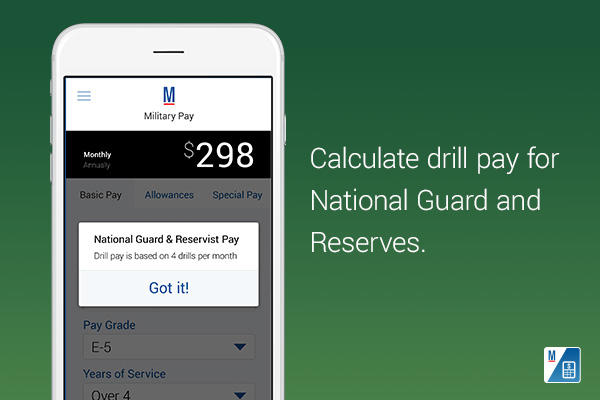

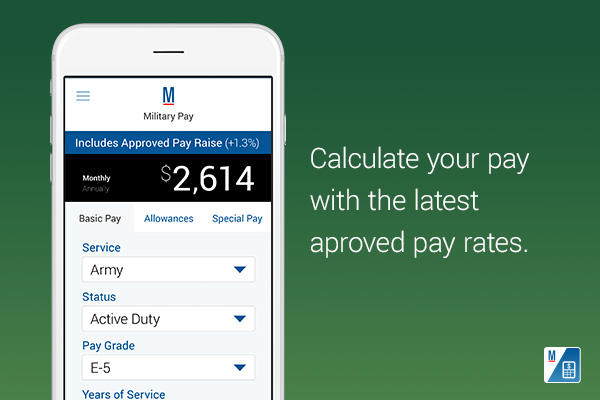

Military Pay App Mobile Pay App Military Com

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

Payscale S Salary Budget Survey Is Open For Participation For 2022 2023 Payscale

Military Pay App Mobile Pay App Military Com

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

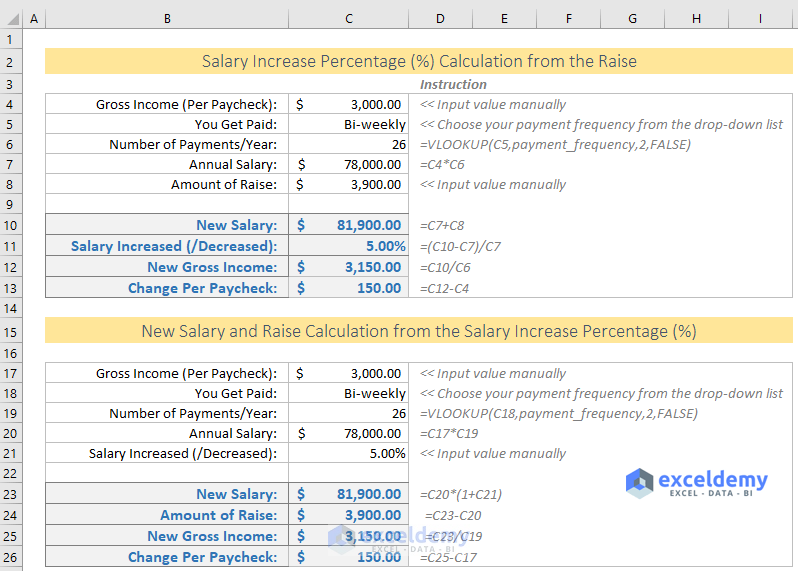

How To Calculate Salary Increase Percentage In Excel Free Template

Military Pay App Mobile Pay App Military Com

Calculator And Estimator For 2023 Returns W 4 During 2022

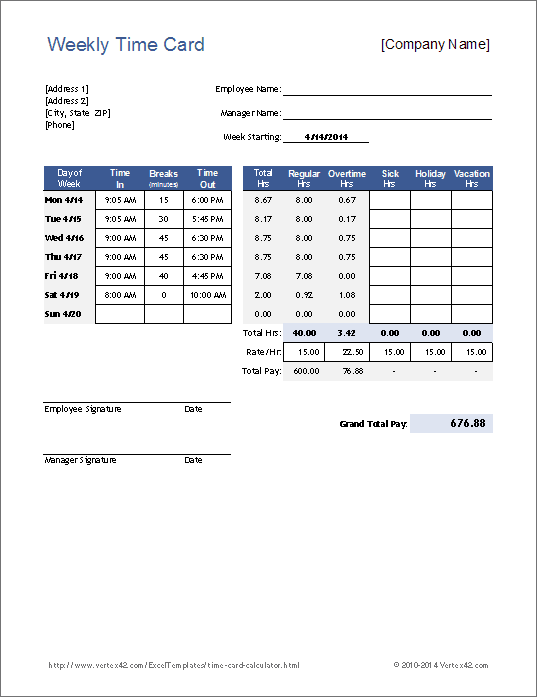

Payroll Template Free Employee Payroll Template For Excel

When Are Taxes Due In 2022 Forbes Advisor

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

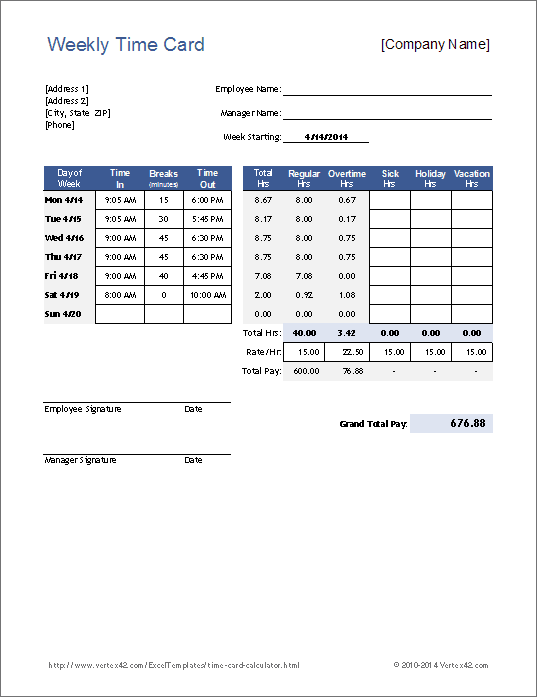

Free Time Card Calculator Timesheet Calculator For Excel

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Revised Salary Income Tax Rates 2022 23 Budget Proposals

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator